The crypto market is constantly evolving and changing. New coins, projects, and methods to exchange and invest in digital currencies emerge every day. Swap farming introduced by Binance and is very similar to staking is one such product. So, what exactly is swap farming, what’s the difference between staking coins and farming coins, and how to get started?

What is swap farming?

With the launch of decentralized exchanges in 2020, swap farming has become a reality. In simple terms, users lend their cryptocurrency to exchange in farms or pools to provide liquidity for trading in exchange for incentives.

Its popularity is growing as the decentralized finance field increases, and users can earn cryptocurrency rewards through farming, which is a more accessible alternative to mining. It allows investors to get the most out of their cryptocurrency investments by paying interest on the coins they buy and keep rather than trading them.

Farming vs. Staking – What’s the difference?

In the crypto market, there are a variety of strategies to generate a sizable passive income. Swap farming vs. staking is one of the most well-examined questions. Crypto staking and swap farming are the two most common strategies for cryptocurrency owners to supplement their income. Swap farming and staking are both excellent ways to create passive income as a crypto holder, and they have a lot in common. The primary distinction is that yield farming necessitates consumers depositing their cryptocurrency cash on Defi projects and sites. Staking is when cryptocurrency investors put their money for a fixed period of time into the blockchain to help validate transactions and blocks. The process is very similar to fixed income assets like bonds – the user stakes the coins and gets an annual yield in return.

Choosing between swap farming and staking to produce a passive income from your crypto assets may come down to choosing between the two. They all, however, necessitate a different level of crypto expertise. Calculating the best ROI between switch farming and staking may lead people to choose swap farming, but the discussion should go further. Swap farming is more difficult for beginner crypto investors to understand. It may take more time and research regularly. Staking crypto provides lower benefits, but it does not necessitate the investor’s constant attention. Certain money can be held for extended periods. It all boils down to the type of investor you want to be in the end.

How to start Swap Farming

Swap farmers support the system since their platform pays them an incentive, just like any other system. Farms with the best yields are usually the most secure and produce the most significant gains. Each blockchain has several produce farms, each with its own set of criteria. Some investors choose to purchase the capital needed to become a swap farmer, while others are more concerned with locating the best yield farm for the assets they already possess. The Binance Smart Chain system is one of the most popular for a multitude of reasons.

Instead of trading directly with another party, automated market makers allow you to trade your coins from a liquidity pool. Tokens are pooled together, and the price of each token is decided by its ratio. For example, one user could contribute an equal amount of BNB and BUSD tokens to the BNB – BUSD pool. Someone else could then utilize these tokens to make a fee-based exchange between BNB and BUSD. Swap Farming offers all of the perks that Binance is known for. There’s no chance of losing money when you utilize Swap Farming, so you may use it with confidence.

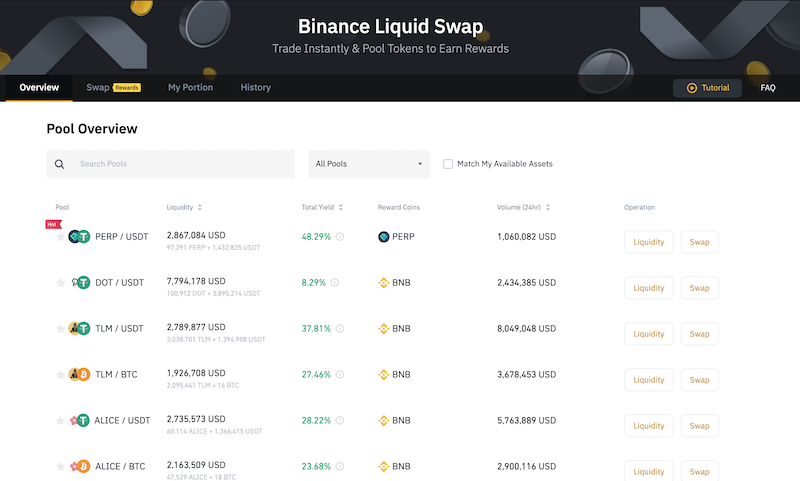

Obviously, any trade or swap carries the risk of slippage, which results in a price that differs from what you expected. However, due to Binance’s industry-leading liquidity, this risk has been reduced via Swap Farming. Swap Farming, in reality, offers over 100 trading pairs, each with high liquidity.

Here’s how to get started in three easy steps through the Binance website.

- Log in to your Binance account first or open a Binance account. Then, on the menu bar, hover over Trade and then click Swap Farming. After that, you’ll be taken to the Swap Farming page.

- Select the token pair you’d like to exchange. Then, you can choose from a variety of cryptocurrencies, and decide whether you wish to swap or simply add the coins you have to a liquidity pool. Next, enter the amount you’d like to trade and double-check the details of your transaction. Finally, slippage and the charge are automatically calculated.

- To continue, click Swap (or liquidity, for that matter). Then, to complete the transaction, click Swap once more. After that, you can begin the process of claiming your prize.

When comparing swap farming to staking, keep in mind that swap farming is still a new approach, and the only way to learn how to get the most out of swap farming is through experience.

- How GPS Trackers are Revolutionizing Asset Protection and Checking - March 14, 2024

- How Many People Lived in the Islamic State (ISIS)? - February 5, 2024

- Israel vs Palestine – What’s Going to Happen? - November 29, 2023